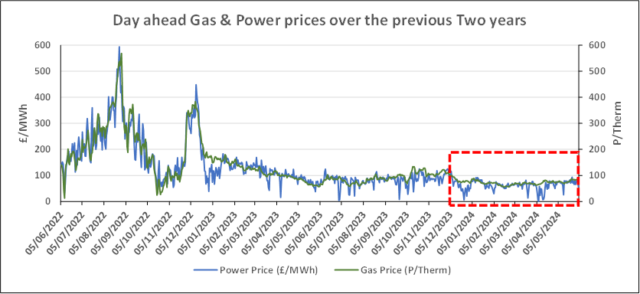

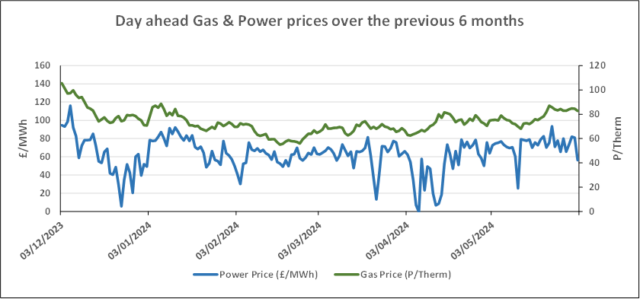

Wholesale Gas and Electricity prices rose sharply in the short term (due to the end of Q3 ’24) with far less volatility further out, albeit still upward.

This was caused by disruption at a Norwegian plant and despite storage sites making up the shortfall, the market reacted in the same way as it did prior to us getting storage above 80% of demand. It’s disappointing that the traders still have this influence on the market.

At a retail level we have seen suppliers pulling prices but we expect the increases to be given back, in the same way as they were last week. Historically, whenever similar situations have arisen, the market has always dropped back.

| Gas: Supply disruption at a Norwegian gas processing plant in Nyhamna caused exports into Britain to fall, leading to bullish movements in NBP yesterday. Storage sites withdrew 19mcm/day in an attempt to counteract the import shortfall. Power: Power prices moved up yesterday, following the significant rises in NBP. The carbon UKA benchmark Dec-24 contract also traded up, adding pressure to the far curve. Wind output for the rest of the week is expected to remain more than 20% above the average, whilst temperatures are also expected to remain above seasonal. Oil: Crude prices fell yesterday off the back of the OPEC+ meeting on Sunday, with the group agreeing to extend its production cuts. Carbon (EU ETS): The ICE Dec-24 ended yesterday at €74.57/t. This morning, the contract is trading similar at €74.56/t at time of writing. Carbon (UKAs): The ICE Dec-24 continued its recent gains yesterday, closing at £48.65/t. This morning, it’s currently trading at £48.08/t. |

#gas #electricity #businessutilities #businessgas #businesselectricity