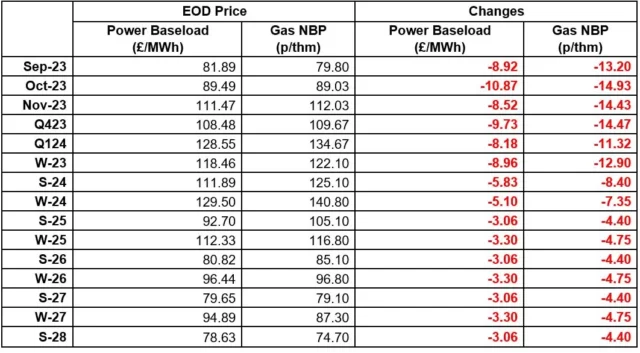

Further considerable drops in prices on Thursday which is welcomed news. Our view is that once the froth created by traders, who are now having to close out positions because no one bought, subsides that prices will be flat going forward or modestly increasing.

The disconnect we saw earlier in the year between gas & electric wholesale price movements has re-emerged. The key W23 electricity price at £118.23/MWh is not quite where it was at the close on 2/6/23 which was this years low point at £114.12/Mwh. Gas however at 122.10p/thm is significantly above the price of 105.45p/thm seen at close on 2/6/23. Electricity pricing is supported by renewables production while the gas market has been driven by speculation which thankfully now seems to be evaporating. In mid March, when we were recommending 6 month contracts, W23 prices were £147/MWh for electricity & 134p/thm for gas so those of you are again renewing now have benefitted, particularly on electricity.

W24 remains, in our opinion, unnecessarily high for both commodities so our recommendation is not to contract that period until next summer when we expect it to be lower.

On the production side see the lower table. Last week renewables contributed 39.6% of UK electricity production, almost overtaking fossil which was at 42%. Interestingly we had a nett import position of 0 for electricity last week.

Interesting times but with speculators hopefully now out of the picture and closing out their positions some sensibility will return. All in all though a more positive outlook for those wishing/needing to contract than we saw earlier in the week.

Wishing you all a good end to your week & bank holiday weekend ahead 🍻

Gas: Gas prices continued to fall yesterday following the ‘in principle’ agreement at the Australian LNG facilities, eliminating any supply concerns. The UK is expected to receive two LNG cargoes by 2 September. Total British gas demand is currently 21MCM under seasonal norms, adding to bearish pressure on prices in the prompt.

Power: Power prices shadowed the gas market yesterday, declining in line with gas contracts. Wind generation is expected to reach 4.3GWs/day next week, 20% below seasonal norm, adding some bullish pressure for fuel fired demand in the prompt.

Crude: Oil prices traded steadily yesterday as the market waits for the US Federal Reserve decision on interest rates. Global manufacturing data showed reduced business activity throughout Europe, the UK, Japan, and the US. Although the market is optimistic about interest rate hike pauses and declining inflation, limiting declines.

Carbon (EU ETS): The ICE Dec-23 closed at €85.84/t yesterday, continuing its recent decline. Opening today at €85.00/t, the contract is currently trading lower at €85.2/t.

Carbon (UKAs): The ICE Dec-23 closed at £47.32/t yesterday. The contract has opened at £47.25/t today, currently trading at £47.6/t.