Welcome drops across the curve Wednesday on both gas & electricity triggered by unions negotiating in Australia to avert the threatened strike which would affect 10% of global LNG supplies.

We expect modest day on day increases to resume once this re-adjustment works it’s way through the market which typically takes a number of days/week. Electric prices had hit a 4 month high on Tuesday.

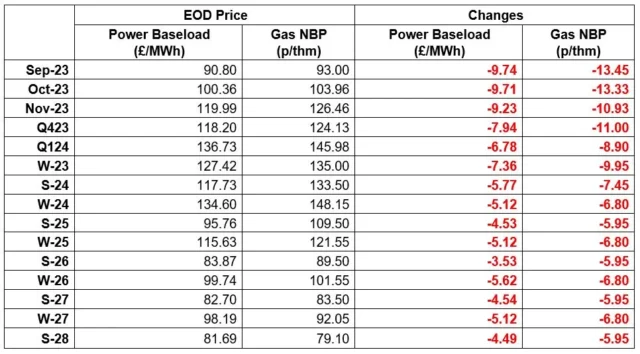

Gas: NBP prices fell throughout the curve yesterday. The threat of Australian LNG strikes could now be over with unions considering the pay offer. British demand was below seasonal norms yesterday, another factor helping to keep contracts bearish. This morning has seen key NBP contracts shed further value.

Power: Volatility within the gas market continued to be a key factor in power pricing yesterday. Prices fell throughout the curve, with the front month contract dropping back from a 2-month high price point. Contrary to this, day ahead prices spiked to a 4 month high backed by a lack of renewable output. Near term contracts have seen further price drops so far this morning.

Crude: Despite oil prices falling yesterday, the downside was limited due to a reduction in US stock levels. There is a sense of nervousness in this week’s oil market. The Federal Reserve has its annual meet, which will likely give insight into what will happen with future economic factors.

Carbon (EU ETS): The ICE Dec-23 closed at €88.22/t yesterday. Opening today at €87.07, the contract is currently trading lower at €86.21/t.

Carbon (UKAs): The ICE Dec-23 closed at £49.88/t yesterday. The contract has opened at £48.6/t today and has continued its descent, currently trading at £47.48/t.