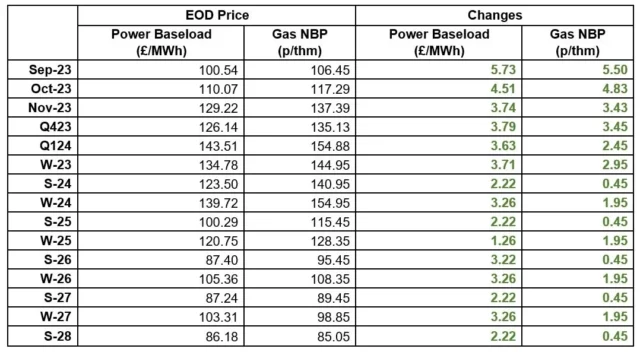

Prices continued to rise on both commodities on Tuesday.

Our advice is to lock in as soon as possible for any contracts expiring before June 24. While the fundamentals support price drops there are macro economic issues influencing sentiment and traders capitalising on issues such as the Australian LNG strike to drive prices higher. We expect prices to continue to rise, albeit not at the rates in the table below, with the odd day of drops going in to winter.

Fortunately the wholesale price increases had largely been factored in at retail but we are now seeing tenders coming back with higher prices on and suppliers are not holding contracts open for acceptance overnight

Gas: Gas prices continued their recent bullish run with support from the Australian LNG strikes, causing global supply uncertainty. Additionally, Norwegian outages and unplanned maintenance at Cygnus and Bacton have further supported the price gains.

Power: Power prices tracked the prices in the gas market yesterday. Furthermore, prompt renewable generation is forecasted to dip 20% below the seasonal norm, averaging 3.9GWs/day.

Crude: Oil prices fell yesterday following the rise of the $USD, causing oil products to be more expensive for non-currency holders. The $USD has hit a multi-month high after US treasury yields rose to multiyear highs.

Carbon (EU ETS): The ICE Dec-23 rose to €89.87/t yesterday. Opening today at €89.76, the contract is trading at €89.73/t at the time of writing, after peaking at €90.23/t.

Carbon (UKAs): The ICE Dec-23 rose to £50.31/t yesterday. The contract has opened at £51.5/t today, and has continued to find strength, currently trading at £52/t.