Mixed movements on Wednesday with more reductions than gains

The market remains stable at retail, with lower prices on longer term contracts which leads us to continue to advise 1 year, or maximum 2 year, contracts.

Gas: The NBP front month contract gained yesterday as Norwegian outages applied pressure. The rest of the curve mainly shed value helped by the news from the British PM that a ban on new petrol and diesel cars has been delayed, now not coming into force until after 2035. This morning the market has opened relatively bearish.

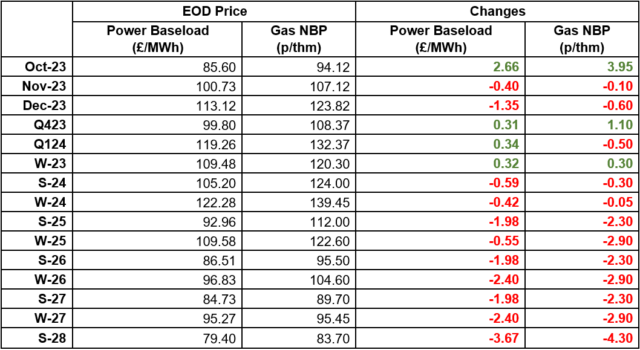

Power: Most Power contracts dropped value yesterday tracking NBP losses. Falling carbon prices compounded the losses on the far curve. Solar power is forecast above seasonal norm over the coming fortnight, averaging between 1.2GW – 1.4GW a day. For today’s price outlook, as of last nights close, please see the below table.

Crude: Oil prices were volatile yesterday as supply concerns weighed against the upcoming decision by the US federal reserve on interest rates. This helped to curb the previous sessions bullishness.

Carbon (EU ETS): The ICE Dec-23 closed at €82.81/t yesterday. Opening higher today at €82.45/t, the contract is trading down at €82.28/t at time of writing.

Carbon (UKAs): The ICE Dec-23 closed at £35.68/t yesterday. Opening today at £36/t, the contract is currently trading at £36.04/t.