Who said the UK has no energy policy 🤔

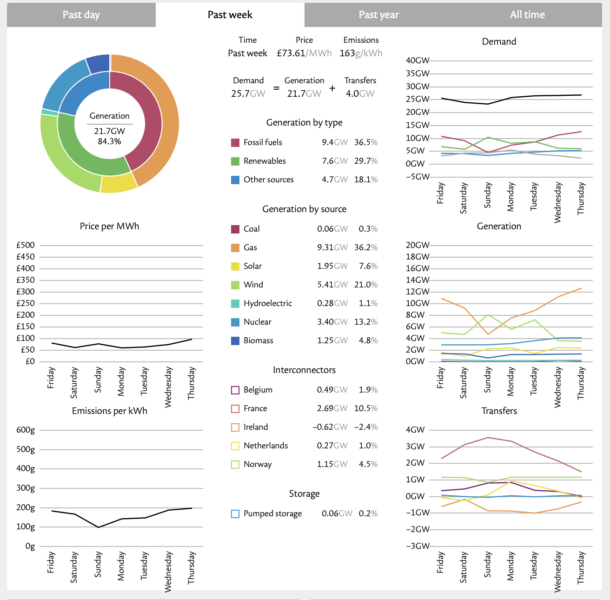

Wind output quadrupled, yes QUADRUPLED, year on year yesterday and the sun’s out. The sun being out not only provides solar power but also drives up average temperatures which in turn reduces energy requirements (despite aircon), taking demand away from gas and therefore softening prices. Normally we’d expect to see electricity soften more than gas in these situations but because of the spike on Wednesday that is not the case yesterday.

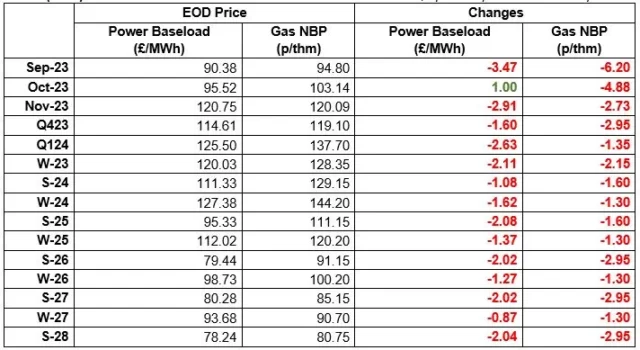

Despite the drops we’re not back at Tuesday close levels yet for W23 or any other period. W23 was £114.63/MWh for electricity and 119p/therm for gas at Tuesday’s close vs £120.03/MWh and 128.35/therm at last nights close.

Our view is that electricity could still drop while gas is on an upward trajectory, despite short term readjustments to Wednesday’s spike. The news from China yesterday regarding deflation is double edged. Demand will be low but the ruling party will be more focussed on their stimulus and may want it to kick in soon given that Chinese New Year (CNY) is early in our New Year and the whole country shuts down for 2-3 weeks then while workers travel home. Our wish would be that, in true Chinese style, they take the long term view so that the stimulus kicks in after CNY. Whether China can absord the loss of face by having a deflationary economy on the world stage is a key question that will impact the price we, and the rsst of the world, pays for natural gas.

On the generation front it’s fascinating – if you like this sort of thing 🥸. On the lower table below you’ll see that last week renewables produced 29.7% of our generation vs fossil fuels at 36.5%. Today renewables are currently at 53.6% with fossil fuels at 12.3%. The balance on both is made up of Other Sources which is predominantly nuclear.

Have a great weekend

Gas: Gas prices softened yesterday especially in the front curve due to a surge of Renewable generation. Wind generation is forecasted to quadruple its output to 8.4GWs today. Furthermore, the system was oversupplied by the end of the day, likely due to warmer weather, 4% under seasonal norm.

Power: Power prices tracked the wider energy complex yesterday, namely Gas. Solar generation is expected to generate above average over the next few weeks.

Crude: Oil prices fell yesterday following investor concerns over weakening consumption in the US. However rising tensions in Eastern Europe limited further declines. US CPI rose by 0.2% last month, totalling 3.2% over 12 months, however investors are unsure if this is enough to stop the Federal Reserve increasing interest rates.

Carbon (EU ETS): The ICE Dec-23 rose to €84.9/t yesterday. Today it opened at €84.7/t and continues to trade at this level at the time of writing.

Carbon (UKAs): The ICE Dec-23 continued its bearish run and closed at £39.76/t yesterday. The contract has yet to trade at the time of writing.